Innovations in Fintech: Revolutionizing Financial Services

Fintech startups are shaking up the traditional banking industry with their innovative approaches and digital solutions. These companies are leveraging technology to provide faster, more convenient, and more customer-centric financial services, challenging the status quo of established banks. By streamlining processes and offering user-friendly interfaces, fintech startups are attracting a new generation of consumers who prioritize efficiency and accessibility in their banking experience.

The rise of fintech startups is also forcing traditional banks to evolve and adapt in order to stay competitive in the rapidly changing landscape of financial services. As consumers increasingly turn to digital banking solutions, traditional banks are investing in technology and partnerships to enhance their offerings and improve customer experience. This shift towards digitalization is not only benefitting consumers with greater choices and convenience, but is also fostering healthy competition that ultimately drives innovation and improvement across the industry.

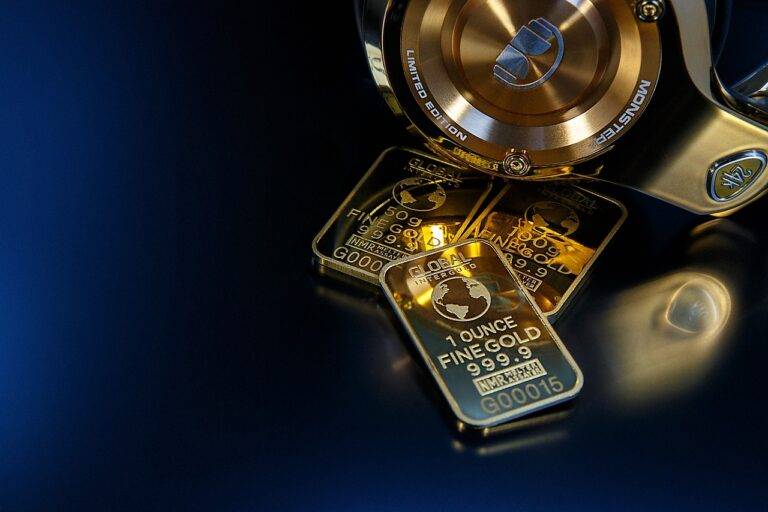

Blockchain Technology Transforming Payment Systems

Blockchain technology has been making significant waves in the realm of payment systems, offering efficiency, transparency, and security like never before. By utilizing decentralized ledgers, blockchain enables peer-to-peer transactions that eliminate the need for intermediaries, reducing transaction costs and time delays. This decentralized approach also enhances trust among parties involved in the payment process, fostering a more secure and immutable system.

Moreover, the use of smart contracts on blockchain technology is revolutionizing payment systems by automating the execution of contractual agreements. This self-executing code operates based on predefined conditions, ensuring that payments are made only when specific conditions are met, thus streamlining the payment process and minimizing the risk of human error or fraud. As more businesses and financial institutions adopt blockchain technology, the traditional payment landscape is undergoing a significant transformation towards a more efficient and secure future.

How are fintech startups disrupting traditional banking?

Fintech startups are leveraging blockchain technology to create faster, more secure, and efficient payment systems that are challenging the traditional banking model.

What advantages does blockchain technology offer in payment systems?

Blockchain technology offers advantages such as increased transparency, security, lower transaction costs, and faster settlement times in payment systems.

How is blockchain technology transforming payment systems?

Blockchain technology is transforming payment systems by providing a decentralized and immutable ledger that eliminates the need for intermediaries, streamlines processes, and enhances security.

What role do cryptocurrencies play in blockchain-based payment systems?

Cryptocurrencies are digital assets that can be transferred securely and quickly over blockchain networks, making them ideal for use in blockchain-based payment systems.

Are traditional banks embracing blockchain technology in their payment systems?

Some traditional banks are starting to explore and adopt blockchain technology in their payment systems to improve efficiency, reduce costs, and enhance security.